Tuesday, June 30, 2015

Consumer confidence in the US increases

The CB consumer confidence index rose to 101.4 in June from 94.1 in May. Bloomberg has a write up on this.

UK economy grows faster that estimated

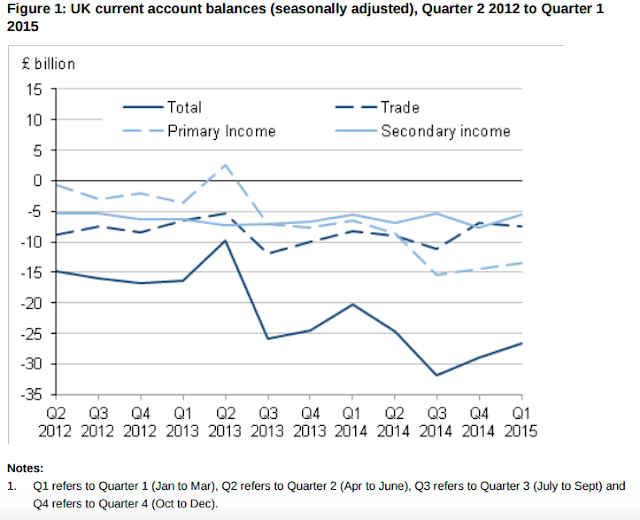

The current account deficit was 26.5 billion for the first quarter, down from 28.5 billion recorded in the forth quarter last year. Other key points include:

- The narrowing of the current account deficit was due to a narrowing in the deficit on the secondary income account and the primary income account, partially offset by a widening in the deficit on the trade account.

- The secondary income deficit narrowed to £5.5 billion in Quarter 1 (Jan to Mar) 2015, from £7.7 billion in Quarter 4 (Oct to Dec) 2014. This was mainly due to the deficit in general government narrowing by £2.0 billion, to £4.5 billion in Quarter 1 (Jan to Mar) 2015.

- The trade deficit widened to £7.5 billion in Quarter 1 (Jan to Mar) 2015, from £6.9 billion in Quarter 4 (Oct to Dec) 2014. This was due to a slight widening in the trade in goods deficit, and a slight narrowing in the trade in services surplus.

- The financial account recorded net inward investment of £24.3 billion during Quarter 1 (Jan to Mar) 2015.

- The international investment position recorded UK net liabilities of £289.3 billion at the end of Quarter 1 (Jan to Mar) 2015.

The full report can be obtained here.

RBA Stevens: The changing landscape of central banking

The Reserve Bank of Australia (RBA) Governor Stevens delivered a speech at the Official Monetary and Financial Institutions Forum in London. He talked about the changes in central banking and the full speech can be viewed here.

Business confidence in New Zealand negative

The ANZ business outlook, a leading indicator of business confidence in New Zealand fell to -2.3 from 15.7 in the previous period. This is the first time that business confidence slipped into the red region since February 2011 when Christchurch experienced a major earthquake.

The business outlook survey can be obtained here.

The business outlook survey can be obtained here.

Sunday, June 28, 2015

Dodd-Frank Act versus the Treasury`s original proposal

I felt like revisiting the past today and writing about the Dodd-Frank Act versus the Treasury`s original proposal. The proposal was made in 2009 whereas the Act was passed a year later in 2010. I will touch on some areas (and not all of them) which I deem are relevant:

Too big to fail

The Treasury initially wanted to increase the FDIC (Federal Deposit Insurance Corporation)`s authority as either a receiver or conservator. Under the Act, the FDIC had the jurisdiction of receivership only. Investopedia has a concise definition of receivership.

Systematic risk regulation

The FSOC (Financial Stability Oversight Council) was to advise the FED (Federal Reserve) in the original proposal. However, in the Act, the FED was to work for the FSOC. To know more about what the FSOC and what it does, head over here.

FED reform

Back then, members of the Congress were pretty upset with the FED and were pushing for a reform. Arguably the most prominent area where a reform was made is in terms of the FED`s authority under Section 13(3) of the Federal Reserve Act. During the pre-Dodd-Frank, the FED could make loans to "any individual, partnership or corporation". It was then restricted to lending via "facilities with broad-based eligibility." This line was intended to prevent bailouts of situations similar to Bear Sterns or AIG.

The Dodd-Frank Act took nearly 13 months to pass and a massive 2 319 page financial reform law. Even today, the battle for financial reform is still ongoing.

Reference:

1. Binder, A.S.(2013). After the music stopped. New York: Penguin Books.

Too big to fail

The Treasury initially wanted to increase the FDIC (Federal Deposit Insurance Corporation)`s authority as either a receiver or conservator. Under the Act, the FDIC had the jurisdiction of receivership only. Investopedia has a concise definition of receivership.

Systematic risk regulation

The FSOC (Financial Stability Oversight Council) was to advise the FED (Federal Reserve) in the original proposal. However, in the Act, the FED was to work for the FSOC. To know more about what the FSOC and what it does, head over here.

FED reform

Back then, members of the Congress were pretty upset with the FED and were pushing for a reform. Arguably the most prominent area where a reform was made is in terms of the FED`s authority under Section 13(3) of the Federal Reserve Act. During the pre-Dodd-Frank, the FED could make loans to "any individual, partnership or corporation". It was then restricted to lending via "facilities with broad-based eligibility." This line was intended to prevent bailouts of situations similar to Bear Sterns or AIG.

The Dodd-Frank Act took nearly 13 months to pass and a massive 2 319 page financial reform law. Even today, the battle for financial reform is still ongoing.

Reference:

1. Binder, A.S.(2013). After the music stopped. New York: Penguin Books.

Friday, June 26, 2015

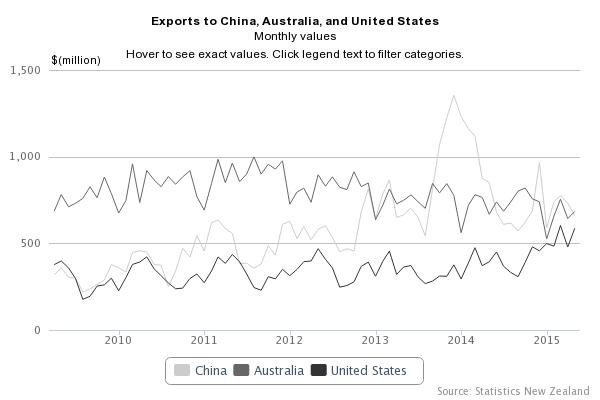

New Zealand trade balance surplus exceeds estimates

The New Zealand trade balance was at a surplus of 350 million compared to 183 million in the previous period.

The key points of the report include:

The key points of the report include:

- Exports fall 4.7 percent

- Imports fall 7.0 percent

- Goods trade surplus of $350 million in May 2015

- Seasonally adjusted exports rise 3.9 percent

- Seasonally adjusted imports rise 0.4 percent

- Exchange rate movements

Thursday, June 25, 2015

US unemployment claims up slightly

The weekly unemployment claims rose slightly to 271 thousand compared to 268 thousand last week.

SNB speech

The Swiss National Bank Chairman delivered a speech titled "The Swiss economy in a weakened world. The full speech can be found here.

Wednesday, June 24, 2015

US final GDP contracts less than expected

German business confidence falls

The German Ifo business climate index fell for the second consecutive month to 107.4 in June from 108.5 in May.

The full report can be obtained here.

The full report can be obtained here.

Subscribe to:

Posts (Atom)