Today Japan recorded the highest inflation level since 1991. Traditionally, based on purchasing power parity, this would in effect weaken the Yen against other currencies.

In addition to the inflation, other economic figures were out today. National core consumer price index (CPI) and housing starts beat estimates, uneployment rate stayed the same while Tokyo core CPI and preliminary industrial production missed targets. While the Tokyo core CPI did not meet estimates, it was still higher that the figure last month (2.9% versus 2.8%)

Initially I went in long for GBP/JPY based on what I expected the effect of inflation would do to the Yen. On a regular day, an increase in inflation without any other external influence would weaken a currency. The bigger picture here is that the inflation growth today is actually a catalyst for the Japanese economy and would positively impact other aspects such as a hike in wages.

The right call was to short either GBP/JPY or USD/JPY. I opted to short USD/JPY as the pound was much stronger than the dollar via the currency strength meter. My positions were short at 101.739, 101.661 and 101.532. The first two gave me a neat profit as my target price for each trade was met, while the third one hit my stop loss as I did not close the position when it still was profiting. I expected the dollar to drop further against the Yen but it did not take place.

Lesson learnt, whenever the third position is in profit territory and the other two trades have met their target price, just close it. A small profit no matter how tiny is better than a loss.

Friday, May 30, 2014

Thursday, May 29, 2014

Shorting USD/JPY based on fundamentals

A board member of the Bank of Japan, Sayuri Shirai mentioned that it would take longer than the originally expected two years for the bank to achieve its targets. As a recap, the Bank of Japan has been increasing its asset purchases to pump in money into the system. This in turn would increase the money supply in hope that inflation rates would go up as more money in the system would weaken the value of the Yen. Japan needs to achieve an inflation rate of 2% for the economy to head into full recovery.

The impact of her speech points to inflation needing a longer time to hit the 2% mark. Based on purchasing power parity, the Yen is set to strengthen temporarily against other currencies, all else being equal. In theory, the exchange rate would be influenced by the purchasing power, where the currency with the lower inflation rate would appreciate against the currency with a higher inflation rate. A more concise explanation of purchasing power parity can be found here.

I shorted USD/JPY at 101.701 and 101.569 and closed both my positions at 101.470

The impact of her speech points to inflation needing a longer time to hit the 2% mark. Based on purchasing power parity, the Yen is set to strengthen temporarily against other currencies, all else being equal. In theory, the exchange rate would be influenced by the purchasing power, where the currency with the lower inflation rate would appreciate against the currency with a higher inflation rate. A more concise explanation of purchasing power parity can be found here.

I shorted USD/JPY at 101.701 and 101.569 and closed both my positions at 101.470

Tuesday, May 27, 2014

Bullish three-drives seen in USD/JPY

I maintained an open long position for USD/JPY at 101.084 since 21/5 and another one at 101.873 today. Both were closed at 102.081. Harmonics pointed to a bullish three-drives as seen in the chart below:

In addition to these positions, I managed to place a few scalps here and there based on support and resistance.

The Fibonacci ratios are met and should give a green light for a buy.

In addition to these positions, I managed to place a few scalps here and there based on support and resistance.

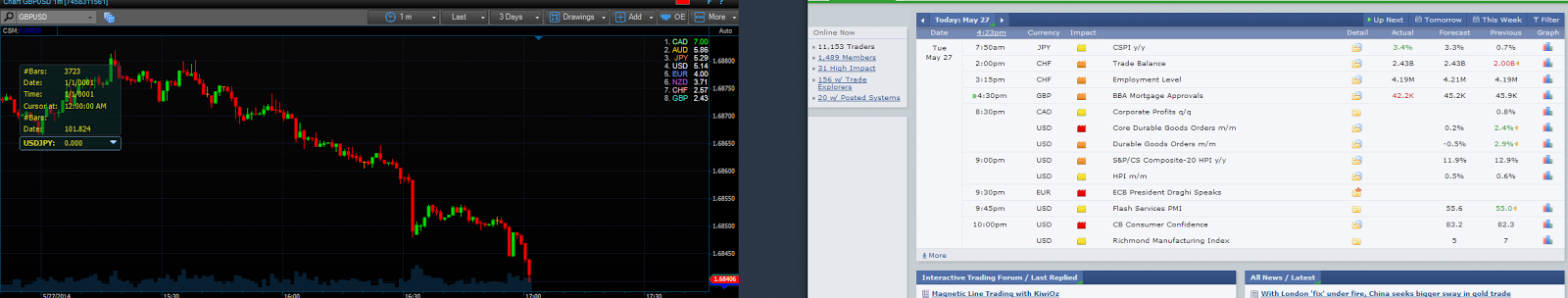

Data trading for GBP/USD

Data trading is perceived as risky by most traders and should be avoided at all costs. However if one catches the trend early, an opportunity for a small gain is possible.

As seen in the picture above, the M1 graph of GBP/USD shows 3 consecutive red candles right after the data for UK`s mortgage approvals was deemed below estimates and lower than the figure last month.

Of course, on a longer time scale, other factors would influence the direction of this currency pair.

As seen in the picture above, the M1 graph of GBP/USD shows 3 consecutive red candles right after the data for UK`s mortgage approvals was deemed below estimates and lower than the figure last month.

Of course, on a longer time scale, other factors would influence the direction of this currency pair.

Monday, May 26, 2014

Hibiscus quarterly report for Q1 2014

This is an analysis on the recent quarterly report for Hibiscus. The report can be downloaded from Bursa Malaysia.

The statement of profit or loss shows an enormous growth in revenue of 154% in comparison to Q1 2013. This should raise eyebrows as the growth may seem too fast for the company to sustain. Another key figure is the administrative expenses have nearly doubled. The final figure for Q1 is a RM156 000 loss after taxation. In contrast, the company made a RM 2 361 000 profit after tax the previous year. This translates to a loss per share figure of 3 cents. The counter closed at RM1.67 per share on 23/5, a day before the announcement was released on Bursa and ended 5 cents lower at RM1.62 today. This is not very far from the actual loss per share taking into effect.

Likewise, the statement of comprehensive income shares the same tone as the profit or loss with a total comprehensive expense of RM 1 474 000 while the previous year generated a total comprehensive income of RM 5 122 000.

Nothing out of the ordinary has changed in the statement of financial position. The net assets per share fell to RM0.71 from RM0.73 last year.

The cash flows highlight an interesting point of the revenue growth being unsustainable. It has an operating loss of RM 969 000 and a net outflow of cash in operating activities of RM 11 650 000. This shows that the core operations of the company is bleeding out the funds.

Net cash is used in investing activities which shows the company is expanding and acquiring assets.

Overall, there has been a drop in cash and cash equivalent which is not a healthy sign for investors.

The statement of profit or loss shows an enormous growth in revenue of 154% in comparison to Q1 2013. This should raise eyebrows as the growth may seem too fast for the company to sustain. Another key figure is the administrative expenses have nearly doubled. The final figure for Q1 is a RM156 000 loss after taxation. In contrast, the company made a RM 2 361 000 profit after tax the previous year. This translates to a loss per share figure of 3 cents. The counter closed at RM1.67 per share on 23/5, a day before the announcement was released on Bursa and ended 5 cents lower at RM1.62 today. This is not very far from the actual loss per share taking into effect.

Likewise, the statement of comprehensive income shares the same tone as the profit or loss with a total comprehensive expense of RM 1 474 000 while the previous year generated a total comprehensive income of RM 5 122 000.

Nothing out of the ordinary has changed in the statement of financial position. The net assets per share fell to RM0.71 from RM0.73 last year.

The cash flows highlight an interesting point of the revenue growth being unsustainable. It has an operating loss of RM 969 000 and a net outflow of cash in operating activities of RM 11 650 000. This shows that the core operations of the company is bleeding out the funds.

Net cash is used in investing activities which shows the company is expanding and acquiring assets.

Overall, there has been a drop in cash and cash equivalent which is not a healthy sign for investors.

Subscribe to:

Comments (Atom)