Tuesday, June 30, 2015

Consumer confidence in the US increases

The CB consumer confidence index rose to 101.4 in June from 94.1 in May. Bloomberg has a write up on this.

UK economy grows faster that estimated

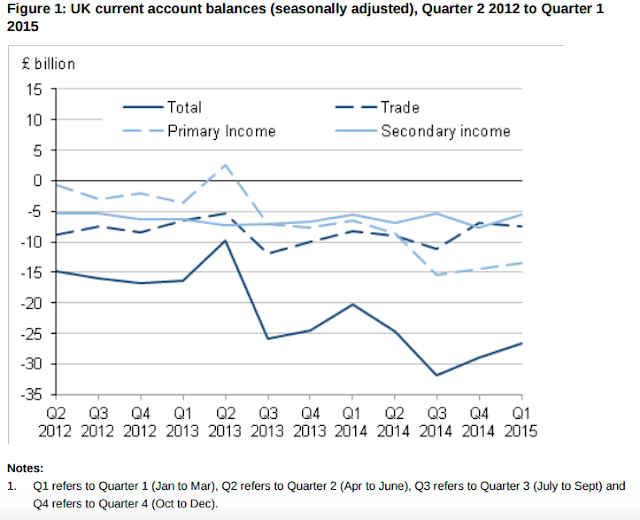

The current account deficit was 26.5 billion for the first quarter, down from 28.5 billion recorded in the forth quarter last year. Other key points include:

- The narrowing of the current account deficit was due to a narrowing in the deficit on the secondary income account and the primary income account, partially offset by a widening in the deficit on the trade account.

- The secondary income deficit narrowed to £5.5 billion in Quarter 1 (Jan to Mar) 2015, from £7.7 billion in Quarter 4 (Oct to Dec) 2014. This was mainly due to the deficit in general government narrowing by £2.0 billion, to £4.5 billion in Quarter 1 (Jan to Mar) 2015.

- The trade deficit widened to £7.5 billion in Quarter 1 (Jan to Mar) 2015, from £6.9 billion in Quarter 4 (Oct to Dec) 2014. This was due to a slight widening in the trade in goods deficit, and a slight narrowing in the trade in services surplus.

- The financial account recorded net inward investment of £24.3 billion during Quarter 1 (Jan to Mar) 2015.

- The international investment position recorded UK net liabilities of £289.3 billion at the end of Quarter 1 (Jan to Mar) 2015.

The full report can be obtained here.

RBA Stevens: The changing landscape of central banking

The Reserve Bank of Australia (RBA) Governor Stevens delivered a speech at the Official Monetary and Financial Institutions Forum in London. He talked about the changes in central banking and the full speech can be viewed here.

Business confidence in New Zealand negative

The ANZ business outlook, a leading indicator of business confidence in New Zealand fell to -2.3 from 15.7 in the previous period. This is the first time that business confidence slipped into the red region since February 2011 when Christchurch experienced a major earthquake.

The business outlook survey can be obtained here.

The business outlook survey can be obtained here.

Sunday, June 28, 2015

Dodd-Frank Act versus the Treasury`s original proposal

I felt like revisiting the past today and writing about the Dodd-Frank Act versus the Treasury`s original proposal. The proposal was made in 2009 whereas the Act was passed a year later in 2010. I will touch on some areas (and not all of them) which I deem are relevant:

Too big to fail

The Treasury initially wanted to increase the FDIC (Federal Deposit Insurance Corporation)`s authority as either a receiver or conservator. Under the Act, the FDIC had the jurisdiction of receivership only. Investopedia has a concise definition of receivership.

Systematic risk regulation

The FSOC (Financial Stability Oversight Council) was to advise the FED (Federal Reserve) in the original proposal. However, in the Act, the FED was to work for the FSOC. To know more about what the FSOC and what it does, head over here.

FED reform

Back then, members of the Congress were pretty upset with the FED and were pushing for a reform. Arguably the most prominent area where a reform was made is in terms of the FED`s authority under Section 13(3) of the Federal Reserve Act. During the pre-Dodd-Frank, the FED could make loans to "any individual, partnership or corporation". It was then restricted to lending via "facilities with broad-based eligibility." This line was intended to prevent bailouts of situations similar to Bear Sterns or AIG.

The Dodd-Frank Act took nearly 13 months to pass and a massive 2 319 page financial reform law. Even today, the battle for financial reform is still ongoing.

Reference:

1. Binder, A.S.(2013). After the music stopped. New York: Penguin Books.

Too big to fail

The Treasury initially wanted to increase the FDIC (Federal Deposit Insurance Corporation)`s authority as either a receiver or conservator. Under the Act, the FDIC had the jurisdiction of receivership only. Investopedia has a concise definition of receivership.

Systematic risk regulation

The FSOC (Financial Stability Oversight Council) was to advise the FED (Federal Reserve) in the original proposal. However, in the Act, the FED was to work for the FSOC. To know more about what the FSOC and what it does, head over here.

FED reform

Back then, members of the Congress were pretty upset with the FED and were pushing for a reform. Arguably the most prominent area where a reform was made is in terms of the FED`s authority under Section 13(3) of the Federal Reserve Act. During the pre-Dodd-Frank, the FED could make loans to "any individual, partnership or corporation". It was then restricted to lending via "facilities with broad-based eligibility." This line was intended to prevent bailouts of situations similar to Bear Sterns or AIG.

The Dodd-Frank Act took nearly 13 months to pass and a massive 2 319 page financial reform law. Even today, the battle for financial reform is still ongoing.

Reference:

1. Binder, A.S.(2013). After the music stopped. New York: Penguin Books.

Friday, June 26, 2015

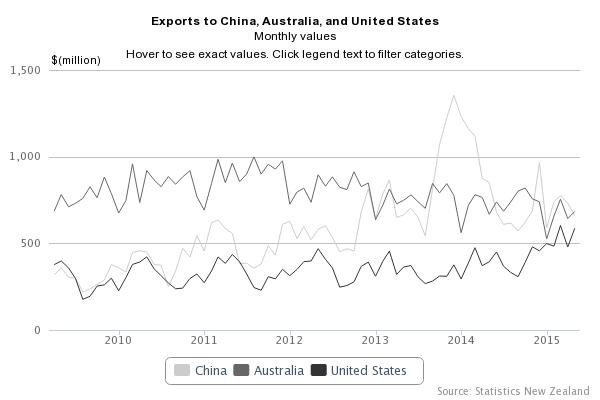

New Zealand trade balance surplus exceeds estimates

The New Zealand trade balance was at a surplus of 350 million compared to 183 million in the previous period.

The key points of the report include:

The key points of the report include:

- Exports fall 4.7 percent

- Imports fall 7.0 percent

- Goods trade surplus of $350 million in May 2015

- Seasonally adjusted exports rise 3.9 percent

- Seasonally adjusted imports rise 0.4 percent

- Exchange rate movements

Thursday, June 25, 2015

US unemployment claims up slightly

The weekly unemployment claims rose slightly to 271 thousand compared to 268 thousand last week.

SNB speech

The Swiss National Bank Chairman delivered a speech titled "The Swiss economy in a weakened world. The full speech can be found here.

Wednesday, June 24, 2015

US final GDP contracts less than expected

German business confidence falls

The German Ifo business climate index fell for the second consecutive month to 107.4 in June from 108.5 in May.

The full report can be obtained here.

The full report can be obtained here.

Tuesday, June 23, 2015

French and German manufacturing PMI green in June

The French manufacturing output recorded the fastest rise since August 2011. The flash manufacturing PMI in June was at a level of 50.5. The full report can be obtained here.

In Germany, private sector output increases at a stronger rate but new order growth slows. The June PMI was at a level of 51.9, up from 51.1 in May. The report can be found here.

In Germany, private sector output increases at a stronger rate but new order growth slows. The June PMI was at a level of 51.9, up from 51.1 in May. The report can be found here.

HSBC flash manufacturing index up slightly

The HSBC flash manufacturing index in June was up slightly to 49.6 compared to 49.2 recorded in the previous month. This level is a 3 month high.

The full report can be found here.

The full report can be found here.

Monday, June 22, 2015

US existing home sales highest since 2009

Sales of existing home sales jumped by 5.1% to increase to 5.35 million homes at an annualised rate. This is the highest jump since November 2009 according to Bloomberg.

I can`t say I like where this is heading. Lower down payment requirements and the fear of the Federal Reserve raising rates are causing even fence-sitters to purchase homes. This spells a recipe for disaster or even the next housing bubble when everyone wants a piece of the action.

I can`t say I like where this is heading. Lower down payment requirements and the fear of the Federal Reserve raising rates are causing even fence-sitters to purchase homes. This spells a recipe for disaster or even the next housing bubble when everyone wants a piece of the action.

Thursday, June 18, 2015

UK CPI at 0.1% in May

The UK CPI (consumer price inflation) recorded a growth of 0.1% in May compared to a contraction of the same figure in April. The inflation report can be viewed here.

US CPI in May

Core CPI (consumer price index) dropped to 0.1% in May from 0.3% in April while CPI grew by 0.4% compared to 0.1% in April.

The inflation report can be found on the Bureau of Labor Statistic`s website.

The inflation report can be found on the Bureau of Labor Statistic`s website.

ECB`s targeted LTRO: 73.8 billion

The European Central Bank (ECB) handed out 73.8 billion to euro area banks. Bloomberg has a good write up on this.

UK retail sales in May up by 0.2%

UK retail sales observed a 0.2% increase in May. This is 26th consecutive month of growth. The full report can be found here.

SNB`s monetary policy unchanged

The Swiss National Bank (SNB) left the monetary policy unchanged. The somewhat generic report can be obtained here.

New Zealand economy grows by 0.2%

The GDP in New Zealand recorded a growth of 0.2%. The GDP report can be found here.

The main points of the report are:

The main points of the report are:

- agriculture was down 2.3 percent, due to lower milk production

- mining was down 7.8 percent, due to decreased exploration activity, and oil and gas extraction

- business services was up 2.1 percent, due to scientific, architectural and engineering, and veterinary services

- retail trade and accommodation was up 2.4 percent, as overseas tourist spending increased

- transport, postal, and warehousing was up 2.5 percent, due to international air transport.

FOMC statement and economic projections

Wednesday, June 17, 2015

Data from UK today : Labour market and MPC

The average earnings index rose to 2.7% from 2.3% in the previous period. The unemployment rate held steady at 5.5%. The labour market report can be found here.

The Monetary Policy Committee (MPC) official bank rate votes remained unchanged at 0-0-9. The minutes of the monetary policy meeting of the Bank of England in May can be found here.

The Monetary Policy Committee (MPC) official bank rate votes remained unchanged at 0-0-9. The minutes of the monetary policy meeting of the Bank of England in May can be found here.

Tuesday, June 16, 2015

RBA monetary policy minutes

The Reserve Bank of Australia`s (RBA) monetary policy meeting minutes can be found here.

Monday, June 15, 2015

Monetary dialogue with Mario Draghi

The video feed for Mario Draghi`s speech before the European Parliament`s Monetary Affairs Committee can be viewed here.

Monday, June 8, 2015

Problems with the Volcker Rule

After the 07/08 financial crisis, many believe that the reintroduction of the Volcker rule would have prevented such a catastrophe. Alan S Binder, the former vice-chair of the Federal Reserve (FED) wrote about the practical problems surrounding the Volcker Rule in his book, "After the Music Stopped."

1. How do regulators distinguish between proprietary trading for the bank`s own account and market making on behalf of clients?

(Answer: With great difficulty.)

2. How can they tell hedging from gambling?

(Answer: Only by knowing the entire portfolio.)

3. If proprietary trading is chased out of heavily supervised commercial banks, where will it go? To less-well supervised investment banks? To totally unsupervised hedge funds? Would that make the financial system safer?

(Answer: It is not obvious.)

4. What if a giant nonbank investment house with a huge trading book was on the verge of failure?

(Answer: Only by knowing the entire portfolio.)

3. If proprietary trading is chased out of heavily supervised commercial banks, where will it go? To less-well supervised investment banks? To totally unsupervised hedge funds? Would that make the financial system safer?

(Answer: It is not obvious.)

4. What if a giant nonbank investment house with a huge trading book was on the verge of failure?

(Answer: That doesn`t sound too appealing.)

Sunday, June 7, 2015

All about spreads

A spread is the difference between the bid and ask price of an asset. To explore further, let`s take a take an example from the US debt market. For example, in 2011 AT&T issued a new 10-year bond at a rate of 4.45%. Since the yield on 10-year US Treasury at that period was 3.34%, the spread was 1.11% or 111 basis points. The difference in the US Treasury yield and the corporate bond is due to the perception of risk associated with the instrument. AT&T was a true blue-chip company, but even so it could not match the US Treasury in terms of risk. US Treasury notes are deemed risk free.

If I were to issue bonds, I`m quite certain the rate would be higher than 4.45% as market participants would view me as someone who is less reputable in terms of paying back my loan compared to AT&T.

How do we quantify spreads? If the holder of a corporate bond has a 20% probability of losing 10% of her money each year, the risk spread on that bond is 20% of 10%, or 2%.

Excessive spread can be detrimental to the economy and there are three main steps in terms of reducing wide spreads:

1) The government takes steps to reduce the perception of risk either in the overall economy or by holding specific securities. The former can be achieved by improving the macroeconomic picture while the latter via mitigating the foreclosure problem.

2) The government can guarantee debts so private investors do not bear the credit risk.

3) The government can buy up securities that are perceived as risky thus bringing up the price and yields down.

If I were to issue bonds, I`m quite certain the rate would be higher than 4.45% as market participants would view me as someone who is less reputable in terms of paying back my loan compared to AT&T.

How do we quantify spreads? If the holder of a corporate bond has a 20% probability of losing 10% of her money each year, the risk spread on that bond is 20% of 10%, or 2%.

Excessive spread can be detrimental to the economy and there are three main steps in terms of reducing wide spreads:

1) The government takes steps to reduce the perception of risk either in the overall economy or by holding specific securities. The former can be achieved by improving the macroeconomic picture while the latter via mitigating the foreclosure problem.

2) The government can guarantee debts so private investors do not bear the credit risk.

3) The government can buy up securities that are perceived as risky thus bringing up the price and yields down.

Saturday, June 6, 2015

Economic updates this week

Friday

The US non-farm employment change showed an increase of 280 thousand jobs in May. Only 221 thousand jobs in contrast were created in April. The unemployment rate however increased slightly to 5.5%, up from 5.4% recorded in the previous period. The employment report can be found here.

Thursday

Australia`s retail sales was static, and the report can be found here. The trade balance was a deficit of 3.98 billion, up from a deficit of 1.23 billion in April. This is the worst deficit since the GFC. The trade balance report can be found here.

Wednesday

Australia`s economy grew by 0.9%, the GDP report can be found here.

In the UK, the services industry grew at a slower pace. The services PMI was 56.5 in May, down from April`s 59.5. The PMI report can be found here.

Minimum bid rate remained at 0.05% in Europe. Head over here for the ECB press conference.

The US trade balance deficit reduced slightly to 40.9 billion. The trade report cane be found here.

The US non-farm employment change showed an increase of 280 thousand jobs in May. Only 221 thousand jobs in contrast were created in April. The unemployment rate however increased slightly to 5.5%, up from 5.4% recorded in the previous period. The employment report can be found here.

Thursday

Australia`s retail sales was static, and the report can be found here. The trade balance was a deficit of 3.98 billion, up from a deficit of 1.23 billion in April. This is the worst deficit since the GFC. The trade balance report can be found here.

Wednesday

Australia`s economy grew by 0.9%, the GDP report can be found here.

In the UK, the services industry grew at a slower pace. The services PMI was 56.5 in May, down from April`s 59.5. The PMI report can be found here.

Minimum bid rate remained at 0.05% in Europe. Head over here for the ECB press conference.

The US trade balance deficit reduced slightly to 40.9 billion. The trade report cane be found here.

Tuesday, June 2, 2015

Chinese PMI in May meets expectations

The official purchasing managers index (PMI) for May was at a level of 50.2, in line with what economists were expecting.

Australia`s Treasury: Sydney is in a housing bubble

Treasury Secretary John Fraser used the term "unequivocally" regarding a housing bubble in Sydney. He was particularly worried about the historically low interest rates which are fueling people to speculate in houses. Bloomberg has a good write up on this.

In terms of building approvals, May declined by 4.4% compared to a gain of 2.9% in the previous month.

In terms of building approvals, May declined by 4.4% compared to a gain of 2.9% in the previous month.

HSBC final manufacturing PMI in May: First contraction of the year

The manufacturing industry continued to deteriorate in May and the weaker demand overseas is said to be the main factor of this. The HSBC manufacturing PMI was 49.2. Although this is a tiny rise from April`s 48.9, it is still below the crucial 50.0 level.

Monday, June 1, 2015

Recommended books on financial history

The former Federal Reserve (FED) chair, Ben Benarnke did a PhD on the great recession. I always believe it`s good for those in finance to know about financial crises and to understand what went wrong so I`ve come up with a list of recommended books.

From the Federal Reserve`s perspective: After the music stopped by Alan S Binder

One of the best books on the 07/08 crisis. Alan S Binder, the former vice-chair of the FED has a way of getting even non finance junkies addicted to his writing. Simply brilliant.

From the Treasury`s perspective: Stress Test by Timothy Geithner

The Treasury has a slightly different jurisdiction compared to the FED and the author is the only person who has served both the FED and later as the Treasury Secretary. Direct and not a book on defending policies.

From the FDIC`s (Federal Deposit Insurance Corporation) perspective: Bull by the Horns by Sheila Bair

Sheila Bair was mentioned in Alan S Binder`s book and it was refreshing to know that she had views that were in contrary to the Treasury and FED.

How Wall Street saw it: The Big Short by Michael Lewis

Michael Lewis writes on how a few elite traders noticed something was wrong from as early as 2005 and how they made their move to profit from it by buying credit-default swaps (CDS).

How London saw it: Reckless The Rise and Fall of the City by Philip Augar

An inside view on how London was holding up to the crisis.

Other European countries: Boomerang by Michael Lewis

The effects of cheap credit and how it caused Iceland`s financial industry to collapse. Briefly touches on Ireland, Greece and Germany.

Central banks: The Alchemists by Neil Irwin

The author talks about the first central bank, which was in Sweden back in the 1600s right up to the present day central banking system. The second half of the book focuses on the actions taken by the FED, Bank of England (BoE) and the European Central Bank (ECB).

From the Federal Reserve`s perspective: After the music stopped by Alan S Binder

One of the best books on the 07/08 crisis. Alan S Binder, the former vice-chair of the FED has a way of getting even non finance junkies addicted to his writing. Simply brilliant.

From the Treasury`s perspective: Stress Test by Timothy Geithner

The Treasury has a slightly different jurisdiction compared to the FED and the author is the only person who has served both the FED and later as the Treasury Secretary. Direct and not a book on defending policies.

From the FDIC`s (Federal Deposit Insurance Corporation) perspective: Bull by the Horns by Sheila Bair

Sheila Bair was mentioned in Alan S Binder`s book and it was refreshing to know that she had views that were in contrary to the Treasury and FED.

How Wall Street saw it: The Big Short by Michael Lewis

Michael Lewis writes on how a few elite traders noticed something was wrong from as early as 2005 and how they made their move to profit from it by buying credit-default swaps (CDS).

How London saw it: Reckless The Rise and Fall of the City by Philip Augar

An inside view on how London was holding up to the crisis.

Other European countries: Boomerang by Michael Lewis

The effects of cheap credit and how it caused Iceland`s financial industry to collapse. Briefly touches on Ireland, Greece and Germany.

Central banks: The Alchemists by Neil Irwin

The author talks about the first central bank, which was in Sweden back in the 1600s right up to the present day central banking system. The second half of the book focuses on the actions taken by the FED, Bank of England (BoE) and the European Central Bank (ECB).

Subscribe to:

Comments (Atom)