The second estimate for the first quarter GDP decreased at an annual rate of 0.7%. In comparison, the first estimate for the same period indicated a 0.2% growth.

The economic report can be found here. Bloomberg has a good write up in case you do not like reading something that looks like it came from a typewriter.

Friday, May 29, 2015

Thursday, May 28, 2015

Second estimate of UK GDP revised to 0.3%

The UK GDP rose by 0.3% in the first quarter, taking the growth of the economy for nine consecutive quarters now. Bloomberg mentioned this is the longest stretch of growth since the 07/08 financial crisis.

The main points of the GDP report are:

The main points of the GDP report are:

- UK GDP in volume terms was estimated to have increased by 0.3% between Quarter 4 (Oct to Dec) 2014 and Quarter 1 (Jan to Mar) 2015, unrevised from the previous estimate of GDP published 28 April 2015.

- GDP was estimated to have increased by 2.8% in 2014, compared with 2013, unrevised from the previously published estimate.

- Between Quarter 1 2014 and Quarter 1 2015, GDP in volume terms increased by 2.4%, unrevised from the previously published estimate.

- GDP in current prices was estimated to have increased by 0.9% between Quarter 4 2014 and Quarter 1 2015.

- GDP per head was estimated to have increased by 0.1% between Quarter 4 2014 and Quarter 1 2015. Between 2013 and 2014, GDP per head increased by 2.2%.

The full report can be found here.

Australian private expenditure contracted in March

The capital expenditure (capex) report for the March quarter is out. Private capex contracted by 4.4%, worse than the expected contraction of 2.3%. The December quarter recorded a contraction of 1.7%. I took some screenshots on the important areas of the report:

Wednesday, May 27, 2015

US consumer confidence up

The CB consumer confidence increased moderately to 94.5 in May, up from 94.3 in April. The full report can be found here.

Tuesday, May 26, 2015

US core durable goods up for the second month

Core durable goods orders in April grew by 0.5%, in line with expectations. In contrast, March had a growth of 0.3%. The volatility is due to the transport component included in this data.

Bloomberg has a report on this.

Bloomberg has a report on this.

New Zealand had a small surplus in April

The trade balance was a surplus of 123 million in April, which was less that the forecast. The drop in dairy exports to China has negatively affected the trade balance. Dairy exports to China are now down to a level seen a year ago according to Stuff.co.nz.

The other highlights of the report include:

The other highlights of the report include:

- Exports fall 5.5 percent

- Imports rise 2.6 percent

- Trade surplus in April 2015

- Seasonally adjusted exports fall 2.0 percent

- Seasonally adjusted imports fall 0.3 percent

- Exchange rate movements

Monday, May 25, 2015

KLSE below the 1800 phychological barrier

The KLSE index closed some 20.12 points lower today, representing a 1.13% drop.

This is the closing level of the KLSE index from 1/4/2015 to 25/5/2015. Data was obtained from Yahoo Finance.

The first significant drop below 1800 was on 21/5 and it has been downwards since then. It is not usual for the index to drop 1% or more in a day. The average index gain per year over the long term is around 10%, with a drop like this, it takes just 10 days to wipe out an entire year`s gain.

The only good news is that the index is just slightly above the level of the first trading day of the year. Check out my earlier post for the first quarter recap.

In short, if one had bought the index on the first day of the year, the gain to date is a mere 0.8%.

This is the closing level of the KLSE index from 1/4/2015 to 25/5/2015. Data was obtained from Yahoo Finance.

The first significant drop below 1800 was on 21/5 and it has been downwards since then. It is not usual for the index to drop 1% or more in a day. The average index gain per year over the long term is around 10%, with a drop like this, it takes just 10 days to wipe out an entire year`s gain.

The only good news is that the index is just slightly above the level of the first trading day of the year. Check out my earlier post for the first quarter recap.

In short, if one had bought the index on the first day of the year, the gain to date is a mere 0.8%.

Sunday, May 24, 2015

BoE confirms EU exit research

The Bank of England (BoE) has confirmed that it is undertaking a study on the implications of leaving the European Union. This was leaked when a member of the BoE governors accidentally forwarded the email to The Guardian.

Reuters has a write up on this.

Reuters has a write up on this.

Janet Yellen`s speech: US economic outlook

Janet Yellen, the chair of the Federal Reserve (FED) delivered a speech at the Greater Province Chamber of Commerce Economic Outlook.

There is nothing new in her speech as the points she touched here are based on her previous official speeches.

Her full speech can be found here.

There is nothing new in her speech as the points she touched here are based on her previous official speeches.

Her full speech can be found here.

Consumer prices rose in April, core CPI growth a 2 year high

Core CPI grew by 0.3% in April compared to a 0.2% growth in March whereas CPI dropped to 0.1% from 0.2% in March. The core CPI growth is the highest growth since January 2013 according to Bloomberg.

The inflation report can be obtained from the Bureau of Labor Statistics.

The inflation report can be obtained from the Bureau of Labor Statistics.

Friday, May 22, 2015

Mario Draghi on inflation and unemployment in Europe

Mario Draghi, the President of the European Central Bank (ECB) delivered a speech earlier in Portugal regarding inflation and unemployment in Europe.

The full speech can be found here. These are some relevant graphs from his speech:

The full speech can be found here. These are some relevant graphs from his speech:

German Ifo business climate nearly unchanged

The German Ifo business climate index dropped slightly to 108.5 in May compared to a 108.6 level recorded in April. This is the first time in 7 months that business confidence fell according to Bloomberg.

Thursday, May 21, 2015

Philly Fed manufacturing index down

The manufacturing survey in May by the Philly Fed showed that business outlook is less optimistic. The index decreased from 7.5 in April to 6.7 in May.

The full report can be found here.

The full report can be found here.

Loss of momentum in home sales: 3.3% drop

Existing home sales fell to 5.04 million in April, a 3.3% drop from March`s sales of 5.21 million. Bloomberg mentioned that this is slowing down the US housing recovery.

The report can be found from the National Association of Realtors.

The report can be found from the National Association of Realtors.

Unemployment claims: 274 thousand

The unemployment claims this week went up slightly to 274 thousand compared to last week`s 264 thousand.

ECB monetary policy minutes

The European Central Bank (ECB) monetary policy minutes can be found here.

I`ve not summarized it yet but will read it over the weekend.

I`ve not summarized it yet but will read it over the weekend.

New Zealand inflation expectations

Inflation expectation rose to 1.9% compared to the previous period`s 1.8% in New Zealand.

UK retail sales beat estimates

Retail sales in the UK grew by 1.2% in April as the warmer weather helped boost demand in clothing. Bloomberg has write up on this.

German PMI indicates slowdown in private sector output

The key points of the German flash manufacturing PMI are:

Flash Germany Composite Output Index at 52.8 (54.1 in April), 5-month low.

Flash Germany Services Activity Index at (54.0 in April), 5-month low.

Flash Germany Manufacturing PMI at 51.4 (52.1 in April), 3-month low.

Flash Germany Manufacturing Output Index at 52.7 (54.3 in April), 3-month low.

In the report, it was also stated that "Both manufacturers and service providers reported slower activity growth, which some panel members attributed to relatively weak demand and rising cost pressures. Mirroring the trend for output, German private sector companies also signalled a weaker rise in new business."

Flash Germany Composite Output Index at 52.8 (54.1 in April), 5-month low.

Flash Germany Services Activity Index at (54.0 in April), 5-month low.

Flash Germany Manufacturing PMI at 51.4 (52.1 in April), 3-month low.

Flash Germany Manufacturing Output Index at 52.7 (54.3 in April), 3-month low.

In the report, it was also stated that "Both manufacturers and service providers reported slower activity growth, which some panel members attributed to relatively weak demand and rising cost pressures. Mirroring the trend for output, German private sector companies also signalled a weaker rise in new business."

Moderate growth in French flash manufacturing PMI

The key points of the French flash manufacturing PMI report are:

Flash France Composite Output Index rises to 51.0 (50.6 in April), 2-month high.

Flash France Services Activity Index climbs to 51.6 (51.4 in April), 2-month high.

Flash France Manufacturing Output Index rises to 48.3 (46.6 in April), 4-month high.

Flash France Manufacturing PMI climbs to 49.3 (48.0 in April), 12-month high.

In addition to those, what caught my eye was:

"Business expectations in the French service sector climbed to a 38-month high in May. Product diversification, new staff recruitment and improved demand conditions are among the factors set to support activity growth according to panellists."

Flash France Composite Output Index rises to 51.0 (50.6 in April), 2-month high.

Flash France Services Activity Index climbs to 51.6 (51.4 in April), 2-month high.

Flash France Manufacturing Output Index rises to 48.3 (46.6 in April), 4-month high.

Flash France Manufacturing PMI climbs to 49.3 (48.0 in April), 12-month high.

In addition to those, what caught my eye was:

"Business expectations in the French service sector climbed to a 38-month high in May. Product diversification, new staff recruitment and improved demand conditions are among the factors set to support activity growth according to panellists."

China`s manufacturing output contracts for third straight month

FOMC minutes: June rate hike unlikely

Earlier, the Federal Reserve (FED) mentioned that it wanted to raise rates but the weakness in growth has made a rate hike in June unlikely.

The minutes can be found here.

The minutes can be found here.

Wednesday, May 20, 2015

MPC minutes

The Bank of England (BoE) just released its Monetary Policy Minutes for May and the full document can be viewed here.

I wanted to highlight this development under the financial markets section:

" Yields on UK, US and German ten-year government debt had increased by between 30 and 45 basis points on the month. Despite the increase on the month, real yields on ten-year UK government bonds continued to be negative and both real and nominal yields remained unusually low. While yields on ten-year Greek government debt had fallen on the month, spreads between the government debt of other periphery economies and German government bonds had widened."

In the last financial crisis, the widening of the debt spreads was one of the symptoms that the economy was tanking.

I wanted to highlight this development under the financial markets section:

" Yields on UK, US and German ten-year government debt had increased by between 30 and 45 basis points on the month. Despite the increase on the month, real yields on ten-year UK government bonds continued to be negative and both real and nominal yields remained unusually low. While yields on ten-year Greek government debt had fallen on the month, spreads between the government debt of other periphery economies and German government bonds had widened."

In the last financial crisis, the widening of the debt spreads was one of the symptoms that the economy was tanking.

Japan`s prelim GDP: 0.6%

Japan`s economy expanded in the first quarter of this year as indicated in the preliminary GDP growth. The growth rate was at 0.6%, faster that the previous quarter`s 0.4%.

Reuters has a good write up on the economic conditions in Japan.

Reuters has a good write up on the economic conditions in Japan.

Tuesday, May 19, 2015

GDT contracted by 2.2% again

The GDT index contracted by 2.2% after a 3.3% contraction a fortnight ago.

Housing starts in US at a 7 year high

Building permits in April surged to 1.14 million, the highest level in 7 years according to Bloomberg.

ZEW economic sentiment: Optimism declines

The ZEW economic sentiment, an indicator of economic health fell to 41.9 compared to 53.3 in April.

The press release can be found here.

The press release can be found here.

UK CPI at -0.1% in April

The UK consumer price inflation (CPI) fell to -0.1% in April compared to no change in March.

The other key points of the report include:

The other key points of the report include:

- This is the first time the CPI has fallen over the year since official records began in 1996 and the first time since 1960 based on comparable historic estimates.

- The largest downward contribution came from transport services - notably air and sea fares, with the timing of Easter this year a likely factor.

- CPIH (not a National Statistic) grew by 0.2% in the year to April 2015, down from 0.3% in March 2015.

The inflation report is provided by the Office for National Statistics.

Australian Monetary Policy Meeting Minutes

The Reserve Bank of Australia`s (RBA) monetary policy minutes can be obtained here.

The cash rate would be lowered by 25 basis points to 2.0%, effective 6 May.

The cash rate would be lowered by 25 basis points to 2.0%, effective 6 May.

Monday, May 18, 2015

Why consumption tax is not the answer (Sneak peek)

I felt like refuting the views of mainstream economists that consumption tax is the answer to the ailing economy of a country. I plan to have it referenced where necessary and this would obviously take time for me to gather all the data and relevant facts. Anyway, this is an introduction of my article:

The year was 1656, a Dutch merchant

named Johan Palmstruch proposed to King Charles X Gustav

on the formation of a banking

institution in Sweden. The Stockholms Blanco was created, and this

paved way to modern central banks. While there were banks before

1656, Palmstruch formulated two revolutionary concepts. Firstly, the

deposited money was used to finance loans. This proved disastrous

later on due to the mismatch of the duration of deposits versus

loans. Deposits back then were short term while loans were repaid

over a longer duration. To solve this issue (and his second

innovation), he introduced the first European banknote which could be

exchanged for the specified amount of gold or silver. With no proper

controls, it was a recipe for disaster certainly. By 1568, this

ticking time bomb finally exploded which lead to the demise of the

Stockholms Blanco and Palmstruch was imprisoned.

Since the Stockholms Blanco, central

banks have played a crucial role when it comes to a nation`s economy.

The German hyperinflation and the Great Depression taught us an

important lesson : When central bankers fail, so do societies. Closer

to the present, during the 07/08 financial crisis, central bankers

from the Federal Reserve (FED), Bank of England (BoE), European

Central Bank (ECB) among others were at the front, putting out the

fire caused by housing bubble that was escalated further thanks to

Wall Street`s packaging of toxic assets.

Bond market meltdown

Earlier on Bloomberg I came across a report where more than $ 450 billion has been wiped out in global bond markets. Here is the link to the interview with JP Morgan`s International CIO of fixed income. He calls it a correction.

This is not a good development in financial markets. Bonds that were worth nothing were part of the financial meltdown during the 07-08 crisis and this does not take into account what toxic assets Wall Street has been cooking up.

This is not a good development in financial markets. Bonds that were worth nothing were part of the financial meltdown during the 07-08 crisis and this does not take into account what toxic assets Wall Street has been cooking up.

Friday, May 15, 2015

Draghi`s speech at the IMF

The President of the European Central Bank (ECB), Mario Draghi delivered a speech at the IMF a few hours ago on the effectiveness of monetary policy. His full speech can be found here.

Thursday, May 14, 2015

US PPI dropped

The producer price index (PPI) for final demand fell 0,4% in April.

The full report can be obtained from the Bureau of Labour Staistics. Bloomberg has a good write up on this as well.

The full report can be obtained from the Bureau of Labour Staistics. Bloomberg has a good write up on this as well.

Australian budget

Australia`s annual budget was made public on Tuesday and I took a screenshot of the key figures of the report

The main indicators would be the economic growth, inflation and labour market.

In terms of economic growth, the GDP for 2014-2015 is expected to remain at its current level before growing at a pace of 2.75% and 3.25% respectively.

Consumer price index (CPI), the leading indicator of inflation points to the risk of deflation. In 2013-2014, the CPI was measured at a level of 3.0% while the CPI figure is projected to drop in 2014-2015 onwards.

The unemployment rate is forecasted to increase which is not a healthy sign at all in the economy.

The main indicators would be the economic growth, inflation and labour market.

In terms of economic growth, the GDP for 2014-2015 is expected to remain at its current level before growing at a pace of 2.75% and 3.25% respectively.

Consumer price index (CPI), the leading indicator of inflation points to the risk of deflation. In 2013-2014, the CPI was measured at a level of 3.0% while the CPI figure is projected to drop in 2014-2015 onwards.

The unemployment rate is forecasted to increase which is not a healthy sign at all in the economy.

NZ retail sales grew by 2.7% for the March quarter

Retail sales was up by 2.7% for the March quarter in New Zealand following a 1.9% rise in the December quarter. The full retail trade report can be found here.

Wednesday, May 13, 2015

US retails sales does not seem promising

Core retail sales dropped to a mere 0.1% growth in April as opposed to 0.7% in March while retail sales was stagnant. Blomberg has a report on this.

BoE`s inflation report: Economic growth trimmed to 2.5%

The Bank of England (BoE) has cut its economic growth. The new growth rate now has been trimmed to 2.5%, down from a 2.9% estimate in February.

The inflation report can be viewed here.

The inflation report can be viewed here.

UK`s labour report

The average earnings index climbed to 1.9% in the first quarter.

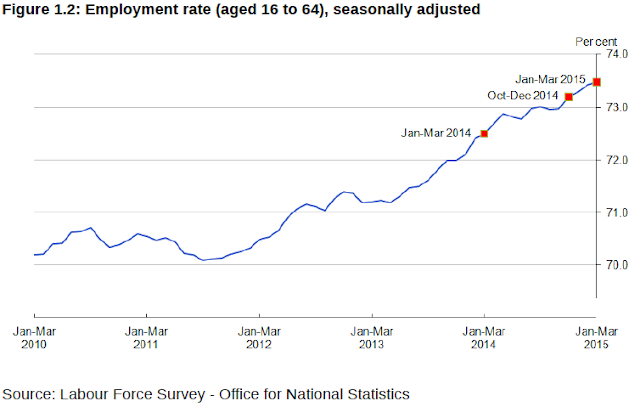

In Figure 1.1 below, while the unemployment rate is single digit, the employment rate is merely 73.5%. This difference is caused by the definition of employment.

In Figure 1.1 below, while the unemployment rate is single digit, the employment rate is merely 73.5%. This difference is caused by the definition of employment.

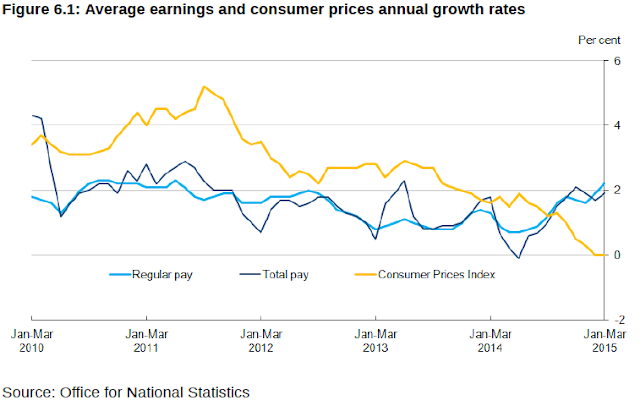

In figure 6.1 below, the average earnings is compared with the inflation. A trend can be seen where wages are rising but inflation is now at a level of 0.

The full labour report can be found here.

Germany`s GDP grew by 0.3% in the first quarter

Germany`s first quarter GDP saw an expansion of 0.3% in the economy.

The GDP report can be obtained here.

The GDP report can be obtained here.

China`s industrial output increases in April to 5.9%

China`s industrial production recorded a growth of 5.9% in April, up from 5.6% in March. Bloomberg has a report on this.

Monthly RBNZ: Changes to loan-to-value ratio (LVR)

In the Reserve Bank of New Zealand`s (RBNZ) financial stability report, the central bank has proposed changes to the loan-to-value ratio (LVR) policy. The new policy will take place effective from 1 October.

The new changes are:

The new changes are:

- Require residential property investors in the Auckland Council area using bank loans to have a deposit of at least 30 percent.

- Increase the existing speed limit for high LVR borrowing outside of Auckland from 10 to 15 percent, to reflect the more subdued housing market conditions outside of Auckland.

- Retain the existing 10 percent speed limit for loans to owner-occupiers in Auckland at LVRs of greater than 80 percent.

It is interesting to note in one of the systematic risks identified, Auckland`s median house price is 60% above its 2008 level. This sounds like a bubble to me and the central bank is being proactive when it comes to mitigating the risk of one.

Tuesday, May 12, 2015

UK`s manufacturing production accelerates the most in 6 months

Manufacturing production in the UK grew by 0.4% in March, the highest rate in 6 month as reported by Bloomberg. The main points of the report are:

- Total production output is estimated to have increased by 0.1% between Quarter 4 (Oct to Dec) 2014 and Quarter 1 (Jan to Mar) 2015. Manufacturing, the largest component of production, is also estimated to have increased by 0.1% between these periods.

- The largest contribution to the quarterly growth came from electricity, gas, steam & air conditioning output, which increased by 2.7%.

- Total production output is estimated to have increased by 0.7% in March 2015 compared with March 2014. There were increases in 2 of the 4 main sectors, with manufacturing output being the largest contributor, increasing by 1.1%.

- Total production output increased by 0.5% between February 2015 and March 2015. The largest contribution to this increase came from mining & quarrying, which increased by 2.6%.

- Manufacturing output increased by 0.4% between February 2015 and March 2015. The main contributors to the increase were basic pharmaceutical products & pharmaceutical preparations; other manufacturing & repair; and rubber, plastic products & other non-metallic mineral products.

- In the 3 months to March 2015, production and manufacturing were 10.2% and 4.8% respectively below their figures reached in the pre-downturn GDP peak in Quarter 1 (Jan to Mar) 2008.

- The preliminary estimate of GDP, published on 28 April 2015, contained an estimated decrease of 0.1% for production in Quarter 1 (Jan to Mar) 2015. This release of data estimates that production increased by 0.1% between Quarter 4 (Oct to Dec) 2014 and Quarter 1 (Jan to Mar) 2015 and the impact on the previously published GDP estimate for Quarter 1 (Jan to Mar) 2015 is less than 0.1 percentage points, rounded to 1 decimal place.

The report can be found here.

Monday, May 11, 2015

Australian business confidence unchanged in April

Business confidence remained unchanged in April at 3.

Saturday, May 9, 2015

China`s CPI misses estimates

The consumer price index (CPI), a leading indicator of inflation grew by 1.5% in April, missing the estimated growth of 1.6%.

Bloomberg has a write up on this.

Bloomberg has a write up on this.

Friday, May 8, 2015

Employment situation in April

The number of jobs created in April is back at a normal level I would say after the non-farm employment change in March added a mere 85 thousand jobs. In contrast, 223 thousand new jobs were created in April.

The unemployment rate fell to 5.4%, a 0.1% improvement from March. This is the lowest unemployment rate since May 2008 as stated in a Bloomberg article.

The non-farm employment change report for April can be found here.

China`s trade balance at 34.1 billion

China recorded a trade balance of $ 34.1 billion. Bloomberg has a detailed write up on the trade situation.

Thursday, May 7, 2015

Australian labour update

Employment change had a drop of 2.9 thousand jobs in April while the unemployment rate remained at 6.2%.

Tuesday, May 5, 2015

ISM services PMI up in April

Non-manufacturing expanded in April according to the Institute of Supply Managers. The services PMI was at a level of 57.8 in comparison to 56.5 in March.

The full report can be found here.

This is not the official government figure.

The full report can be found here.

This is not the official government figure.

US trade deficit at a 6 year high

UK construction growth slows down

Construction growth slowed down in April as indicated in the PMI report. The construction PMI was at a level of 54.2, down from 57.8 in March. This is the weakest rise in 22 months, since June 2013.

Other key points include:

- Robust pace of new job creation, despite slower rise in new orders.

- Sharpest increase in sub-contractor prices since 1997.

Other key points include:

- Robust pace of new job creation, despite slower rise in new orders.

- Sharpest increase in sub-contractor prices since 1997.

Spanish unemployment reduced

Spanish unemployment numbers show a drop of 118.9 thousand, nearly double of that in the previous period.

However, this figure could be dodgy considering regional elections is coming soon.

The full report can be found here albeit in Spanish.

However, this figure could be dodgy considering regional elections is coming soon.

The full report can be found here albeit in Spanish.

Cash rate remained at 2.0%, and another generic RBA statement

The cash rate in Australia remained at 2.0%. In terms of the Reserve Bank of Australia`s statement, it was a generic one. The statement can be found here.

Monday, May 4, 2015

China`s manufacturing PMI declined again

The HSBC manufacturing PMI recorded a level of 48.9 in April, down from 49.2 in March. This is the unofficial PMI figure and any level below 50.0 indicates a contraction in the industry.

Australian building approvals up

Building approvals increased at a rate of 2.8% compared to the prior period`s contraction of 1.6%.

Australian PPI grew by 0.5%

The March key figure showed a growth of 0.5% in terms of the price change of finished goods.

Usually, after a solid Chinese data as seen in my earlier post, Australia would show positive figures.

The full report can be found here.

Usually, after a solid Chinese data as seen in my earlier post, Australia would show positive figures.

The full report can be found here.

Friday, May 1, 2015

ISM manufacturing PMI holds

The ISM manufacturing PMI remained unchanged at 51.5. Do take note that this is not the official figure and does not have a major impact on dollar pairs.

UK manufacturing growth drops

China`s manufacturing PMI in April slightly higher than estimates

China`s manufacturing PMI in April beat estimates by the tiniest bit, with the actual figure indicating a growth of 50.1 vs 50.0. Still CNBC mentioned that this is a sign that the economy is struggling to gain momentum.

Subscribe to:

Comments (Atom)